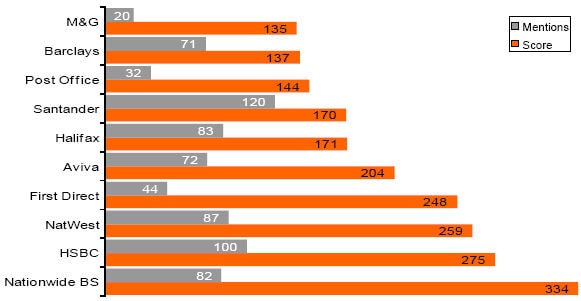

Last month UK national press coverage of financial products was most favourable about Nationwide Building Society. This is according to the latest Presswatch Financial report based on research by Kantar Media.

Presswatch Financial top ten for August 2012

Source: Presswatch Financial, Kantar Media

So are financial journalists prejudiced in favour of Nationwide because it isn‘t a bank, or does it gain such good coverage because of the excellence of its products, service and (naturally) PR efforts? Gabriel Dabner, editor of Presswatch Financial reckons that the big high-street banks have a lot of bad feeling to counter before they can get the sort of coverage a building society can expect, but even so Nationwide is excellent at building its brand. He explains: “Nationwide BS has always punched above its weight in terms of favourable media coverage and recent months have been no exception. With a wave of scandals such as Libor fixing and the mis-selling of payment protection insurance (PPI), the media has often focused on alternatives to the big high-street banks and Nationwide has been a major beneficiary of this trend. It continues to pursue its strategy of building brand loyalty by offering special deals to existing customers: in August it launched a regular savings account paying six per cent interest, available only to Nationwide current account holders.”

Libor and mis-selling of PPI have obviously been bad for banks’ reputations, but Tom Leatherbarrow, head of B2B agency Willoughby Public Relations, believes the main problem with banks concerns lending: “The big players have missed their Project Merlin targets and continue to make it very difficult for business to gain access to capital, in particular SMEs. This is why business secretary Vince Cable continues to argue for increased support for SMEs and an infrastructure bank. The negative media coverage comes from this central issue which is playing a very significant role in holding back the economic recovery.”

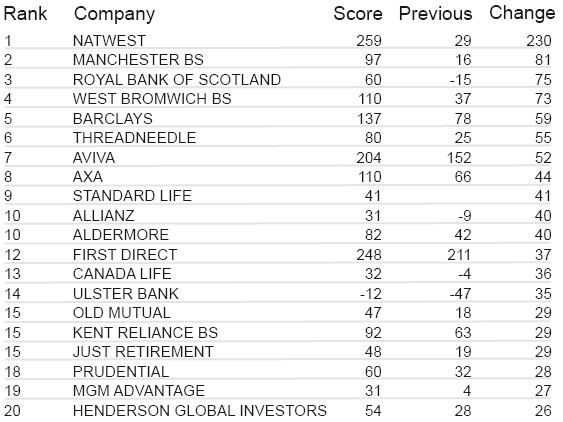

Greatest increase in Main Table score from last month

Source: Presswatch Financial, Kantar Media

Leatherbarrow argues that building societies may be popular right now, but they must be careful if they are to maintain their good image: “The mutuals have not been saints over the last decade, witness the collapse of the Dunfermline Building Society, but now building societies find themselves on the right side of history. From being unfashionable in the 1980s and 1990s, the mutuals now find that they can offer an alternative to the globalised and faceless banks and more positive media coverage reflects this. The danger for them, is that some of the mutuals are now so big that they risk losing their more friendly status in the minds of the consumer and become, in effect, quasi-banks.”

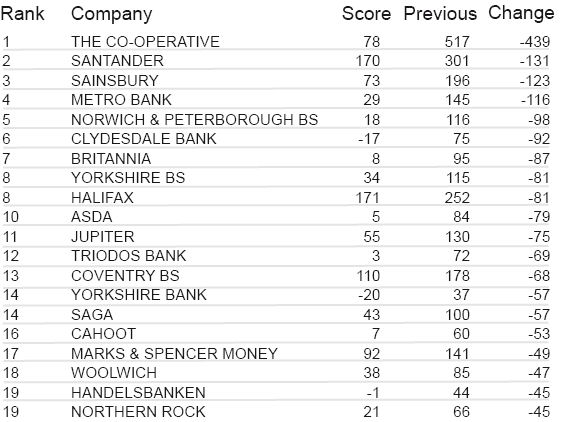

Greatest decrease in Main Table score from last month

Source: Presswatch Financial, Kantar Media

Kantar’s Dabner points out that there are glimmers of hope for high-street banks as not all recent publicity has been bad publicity: “It hasn’t all been doom and gloom for the banks. With a new academic year about to begin, HSBC and Halifax were frequently identified as offering the most generous interest-free overdrafts to undergraduates. And NatWest, hit by an IT glitch this summer that had customers fuming, has fought back thanks to some headline-grabbing mortgage deals.” The increase in NatWest’s positive coverage means that last month it received the greatest increase in positive coverage, whereas The Co-operative recorded the greatest decrease in favourable mentions.

Methodology

All information above is based on findings from the latest Presswatch Financial published by Kantar Media, that each month analyses UK national press coverage (including the Evening Standard) given to named company financial products. The scoring system creates a league table of companies whose individual positions reflect both the volume of coverage and whether or not that coverage is favourable.

PRmoment Leaders

PRmoment Leaders is our new subscription-based learning programme and community, built by PRmoment specifically for the next generation of PR and communications leaders to learn, network, and lead.

PRmoment LeadersIf you enjoyed this article, sign up for free to our twice weekly editorial alert.

We have six email alerts in total - covering ESG, internal comms, PR jobs and events. Enter your email address below to find out more: