Never undervalue the power of a company‘s reputation – it is a vital contributor to profitability. This is highlighted by a recent study by intangible asset specialists Reputation Dividend, which shows that the corporate reputations of companies listed on the London Stock Exchange account for £911bn. A figure that has more than doubled in the past four years.

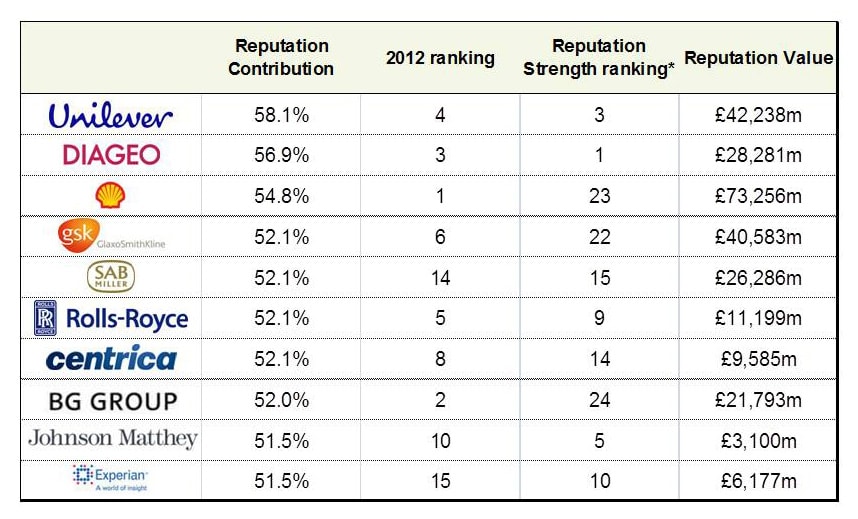

In the UK the brands with the most valuable reputations are Unilever, Diageo and Royal Dutch Shell. Unilever leads the way, helped by its strong position on ethical performance. The study calculates that that the improvements to the company’s reputation were responsible for nearly £7bn of incremental value or 88 per cent of the increase in its market capitalisation.

The UK's most potent corporate reputations

Discussing what the report means for communications professionals, Sandra Macleod, director at Reputation Dividend, says: “In a year marked by continued banking fraud, PPI mis-selling, supply-chain issues such as the horsemeat scandal, and sweatshops in the fashion industry, there is a growing need and appetite for companies to be held to accountable for their reputations above and beyond delivery of financial performance and in a way that assures investors and stakeholders that sound management is in place.

“While communications budgets continued to feel the pinch last year, their impact was more significant than at any time since the downturn started. Communications leaders should take a lot of credit for building the value of the assets in their charge. The growing professionalism of the function and its impact on corporate decision-making paid dividends.”

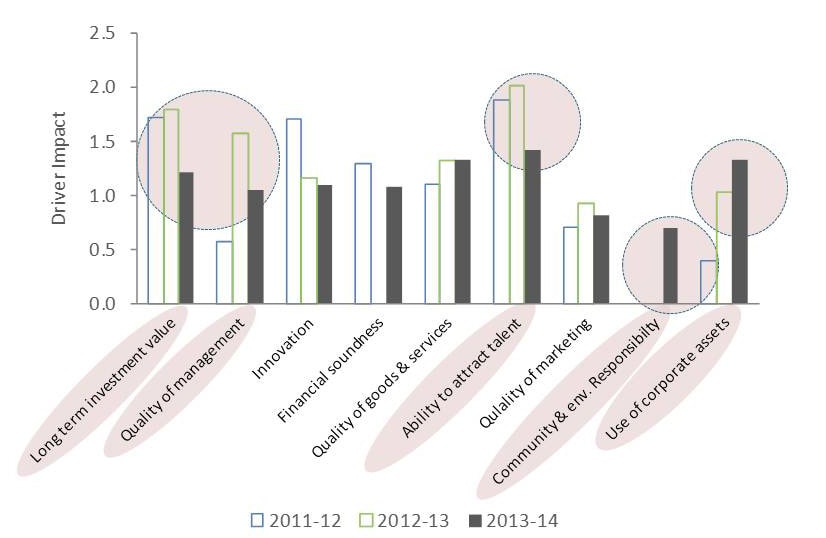

The reputation drivers that are making a difference

When it comes to putting out the right messages about a brand, it makes sense to focus on the subjects that are of most interest to investors. The study found that messages that mattered most to investors in 2013 were dominated by “growth” characteristics. Perceptions of companies’ “ability to attract talent” and “use of corporate assets” are the two most vital characteristics, with messages relating to a companies’ “ethical, community and environmental” credentials starting to really matter for the first time in three years.

Macleod comments: “This is a consequence of the growing criticism of, for example, ‘exotic’ tax planning practices more often than not described by the media as means to avoid payments. Investors may well recognise such activities as effective tax management but, when not handled carefully or without ‘compensatory’ actions such as demonstrations of good citizenship, they are something that could have a deleterious effect on consumer attitudes and ultimately, revenues.”

Background

Reputation Dividend is an index of the financial value of corporate reputation as measured as a percentage of market capitalisation. This is the seventh Annual Report, covering some 160 of the largest companies in the UK. The 2013-14 UK study ran in parallel with its sister US study and was based on data reported from late 2013 through to the start of 2014.

PR Masterclass: The Intersection of PR and GEO

Join PRmoment for a Masterclass featuring 10 of the industry’s foremost experts. You will walk away with a clear, actionable strategy for adapting your content to an AI-first search environment.

Taking place on Wednesday 25th February in London, both virtual and in person tickets are available.

If you enjoyed this article, sign up for free to our twice weekly editorial alert.

We have six email alerts in total - covering ESG, internal comms, PR jobs and events. Enter your email address below to find out more: