Compared with previous generations, millennials have strikingly different expectations of financial services. This is impacting the way they spend and save in the UK. Whether they have little loyalty towards high-street banks, adopt new forms of payments or are just generally more financially astute – times are changing and this should influence the way financial service brands communicate with millennials. A recent report from MWW PR, How Millennials are Shaking Up the Way We Save and Spend in the UK, explains how the communications industry can capitalise on the spending and saving patterns of millennials. Some key findings are below.

Millennial money mindset

*Nearly two-thirds (63%) of millennials agree that it is important to spend time researching the best ways to save and invest money

*48% of millennials find information on finances and investing difficult to understand

It doesn’t appear that education establishments are providing pupils with the tools and knowledge to be mindful of their personal finances. Such a lack of understanding might, in part, explain why millennials are proactive and more willing to research and spend time exploring the financial services that they need. We are seeing more brands play a part in this process, but it is imperative that the information they provide online is clear and concise. A straightforward content strategy can help millennial consumers understand and engage with products that brands provide in an uncomplicated, relevant way.

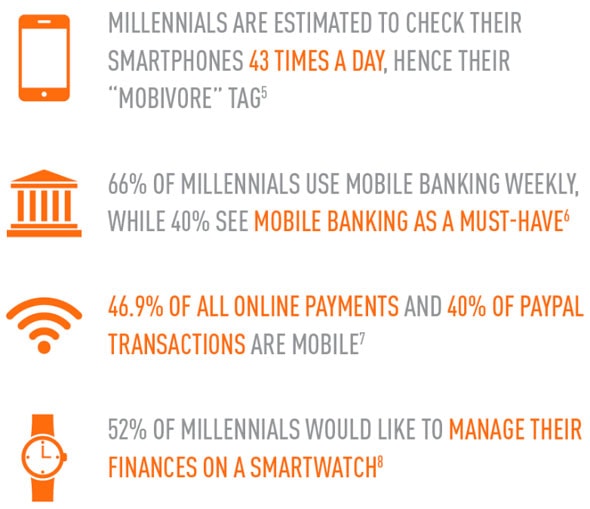

The technology experimenter

*51% of millennials have been more interested in digital banking because of wearable technology

This might not appear like a particularly high figure, but we can see in today’s market how long it can take for payment technology to achieve scale. Contactless payments, for instance, are still taking a significant amount of time to grow outside of London. For brands, highlighting the consumer experience is fundamental to promote the benefits of a new technology, such as convenience and time-saving. Live demonstrations of technology should always be the communications blueprint in order to effectively explain to external stakeholders how a service works, and why it is better than the existing status-quo.

The challenger brands

*49% of millennials would consider using financial services from companies such as Google and Apple compared to just 16%of older consumers

Arguably the most fascinating area of research is the rise of challenger brands, from lesser knowns such as Atom, to the bigger players like Apple and Google, all looking to make in-roads into the financial services market. More established brands are still fighting fires when it comes to trust, given recent scandals, so there is still a need for better transparency to help bring back trust amongst customers. Listening to and engaging with customers on social media in an authentic way can help a brand understand what millennials want to talk about and how they might want to engage with it. Alongside this, any customer complaints which may arise through this medium should be seen as an opportunity for the brand to address them in an open forum where deep engagements and meaningful conversations with millennials can be had.

Understanding millennials

For communications professionals in the financial services industry, the most important action is to show that you truly understand millennials. We must not forget that, whether a customer is spending or saving, it is a means to an end. Therefore, the millennial’s motivation, the emotions and rationale behind what they do, should all be considered by the brand as it helps them along their financial journey.

References

Stats quoted in this feature come from the following sources:

- http://downloads.mintel.com/private/8Eztk/files/462289/ (Millennial and Financial Services, UK May 2015 from Mintel)

- http://downloads.mintel.com/private/8Eztk/files/462289/ (Millennial and Financial Services, UK May 2015 from Mintel)

- https://www.finextra.com/news/fullstory.aspx?newsitemid=28009

Makovsky Wall Street Reputation Study. NY Makovsky

Written by Ked Mather, senior account director at PR agency MWW London

PRmoment Leaders

PRmoment Leaders is our new subscription-based learning programme and community, built by PRmoment specifically for the next generation of PR and communications leaders to learn, network, and lead.

PRmoment LeadersIf you enjoyed this article, sign up for free to our twice weekly editorial alert.

We have six email alerts in total - covering ESG, internal comms, PR jobs and events. Enter your email address below to find out more: